There’s nothing like Twitter to gauge sentiment, and what began as a simple reply to a popular post that warned of a housing market crash worse than 2008 brought out some angry growls.

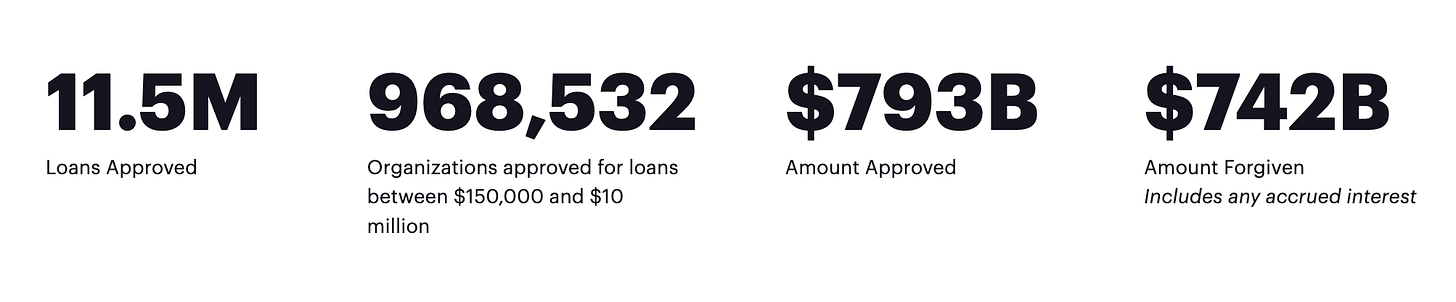

Now I understand it’s a quick and dirty summary, and I often like to hit back with Econ 101 stuff to make a bigger point. Of course, the similarities exist with 2008 that rates are higher and home values have risen too far, but for different reasons and very different consequences. As I’ve discussed in past substacks, this unprecedented 2020-22 man-made macro cycle created interesting economic dislocations. A faux recession, where max employment was maintained and many received tax-free windfall PPP money (see below), resulting in the average consumer more financially healthy than before the pandemic.

A “recovery” without job losses combined with people flush with new cash, paying down debt, and maxing out credit scores. Consumers are in the same great spot financially that they were before 2020, even after accounting for the stepped-up prices of a post-pandemic world.

Many other non-economic differences between 2023 and 2008 - lending standards, housing speculation, banking regulation - but Twitter brings out the gloomiest people that come with one dire statistic. I discussed the last favorite bearish talking datapoint - job cuts - explaining that these companies simply over-hired and needed an adjustment. Most of these tech companies have never been through a healthy right-sizing of a company’s biggest expense, and the market celebrated the improved profit-margins.

Beyond peak cycle also extends to housing, and certainly the value of homes will reset back to normal trend growth. It’s already happening, and home prices have fallen, but nobody in a home has to care because they have a job and a 4% mortgage. In 2008, banks and speculators were holding houses as inventory, so falling home values forced sellers. Today, the only concern the average homeowner has in the price of housing is the monthly Zillow email with the updated worth of your home. In 2008, falling prices created more supply. In 2023, falling prices brings in demand.

But let’s get back to the Bear’s latest flashing red stat - savings rate has plunged. What I love about statistics, and why I punished myself for another 6 quarters getting post-grad engineering degree in Probability and Statistics, is that a datapoint taken absolutely can be misleading. Data is relative, especially with time-series, and if combined properly can actually be predictive. So let’s look at the absolute datapoint: Personal Savings Rate.

First thing I often say when I’m handed a post-2019 chart is “zoom out”, treating 2020-22 as some artificial outlier that’s easy to find the data on any chart. Zooming out to pre-2008 gives the forest view, and it shows a savings rate near the lows. But what stands out is the two spikes that doubled and tripled the savings - how does that compare historically? Zoom out.

Zoomed out and the unprecedented gift to already working families and businesses is clear to see. It’s why consumers remain strongly consuming, perplexing the forecasters.

Bears will have you believe we spent all this money on groceries, gas, and rent, and although that is true for the bottom 25%, most of the cash went elsewhere. One place was, ironically, buying homes outright - enough free money for 1/3rd of buyers to write a check for a house last year. Higher rates don’t matter to a buyer with bulging savings account. For the rest, rising rates are going to slow housing demand, but to levels more consistent with 1990s than 2008. Rising rates also chilled supply, with only new construction available as homeowners with 4% mortgages sit tight.

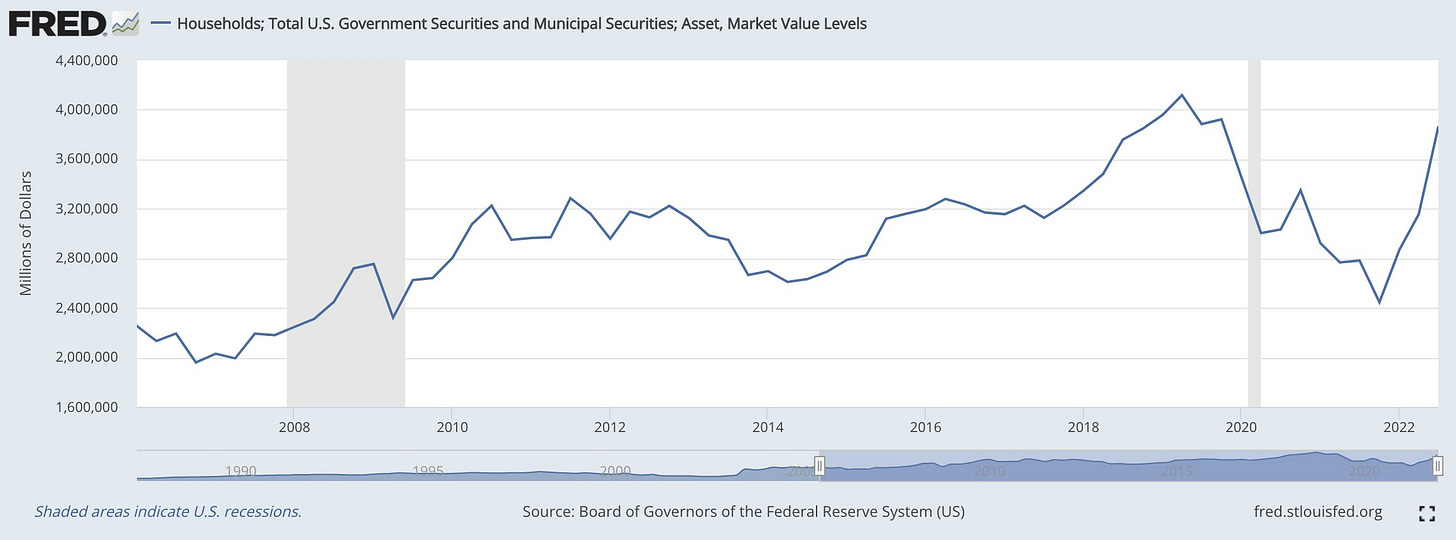

Rising rates also gave a risk-free alternative to 0% savings accounts, with 5% from 2-yr notes or tax-free munis to 8% structured notes. That cash was finally put to work, but it will mature and be available as future savings. The plunge in Savings Rate looks like the inverse of the spike in Govt Securities.

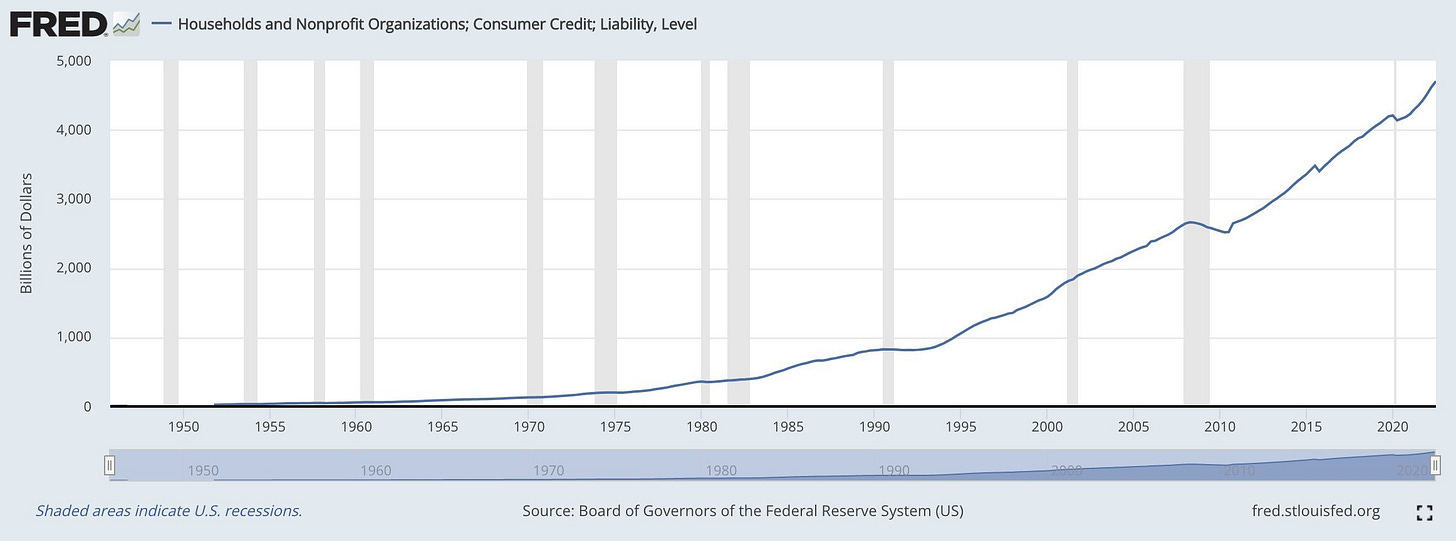

But what about credit? Credit card balances are rising, yet that tells you nothing other than Americans love to spend as long as they have income. Debt grows until there’s a recession, but does not cause one.

And one of the most upside-down charts is how Net Worth surged coming out of a “recession”, which should tell you it was a recession in name only. In fact, as you compare to prior shaded periods, you should reverse your expectations as to what follows.

Too much cash. Absolutely, the savings rate has plunged, but from historic levels and into homes and risk-free alternatives to savings. Too much demand - max employment, low income/debt ratio, tight supply - a consumer much stronger than 2008. As a result, the housing market will recede, as all inflated assets have, but will settle at a lower level without crashing.

Strong assessment, Mike. How do you feel about the housing in other overinflated countries that are dependent on variable rates like Canada, Australia and the UK?