The man-made Macro cycle

A true outlier that renders historical comparisons obsolete.

It was all a dream. Most of us would like to forget 2020-2022, a 3-year span that we will study for years to come. Unprecedented global shutdown, historic levels of printed money in response, zero rates for very long, and the most upside down supply/demand imbalance on restart. Macro values that I model measure cycles that move from Improving/Declining and into valleys and peaks. These Macro Upgrades/Downgrades typically average twice a year, but 2022 created 5 complete cycle turns. Macro cycles occur naturally, so the ability to accelerate them 150% is only possible through man-made impacts.

Therefore, it’s important to start our benchmark before 2020. Macro was doing just fine in 2019, with moderate growth and inflation, max employment, and higher asset prices. Below is Macro Bullish at end of 2019, recommending an OverWeight allocation to equities.

Then 2020 happened. Each decision created a different problem downstream. A man-made 2020 lockdown resulted in a 2021 supply chain bottleneck and demand surge that exasperated inflation. Artificially slowing supply while sparking demand created an unprecedented supply/demand ratio. With PPP, people that were already gainfully employed received windfall amounts of free money resulting in early retirements, the 2021 stock market and BitCoin frenzy. Add in zero rates to get the ingredients of a man-made housing bubble.

I spoke in detail last post that 2022 was the beginning of the reset. Macro went beyond Peak Cycle during 2020-2021, an unnatural event that will caveat the standard year-over-year comparisons. Inflation wouldn’t be going away until supply/demand balance gets back to normal trend, and transitory will eventually be correct.

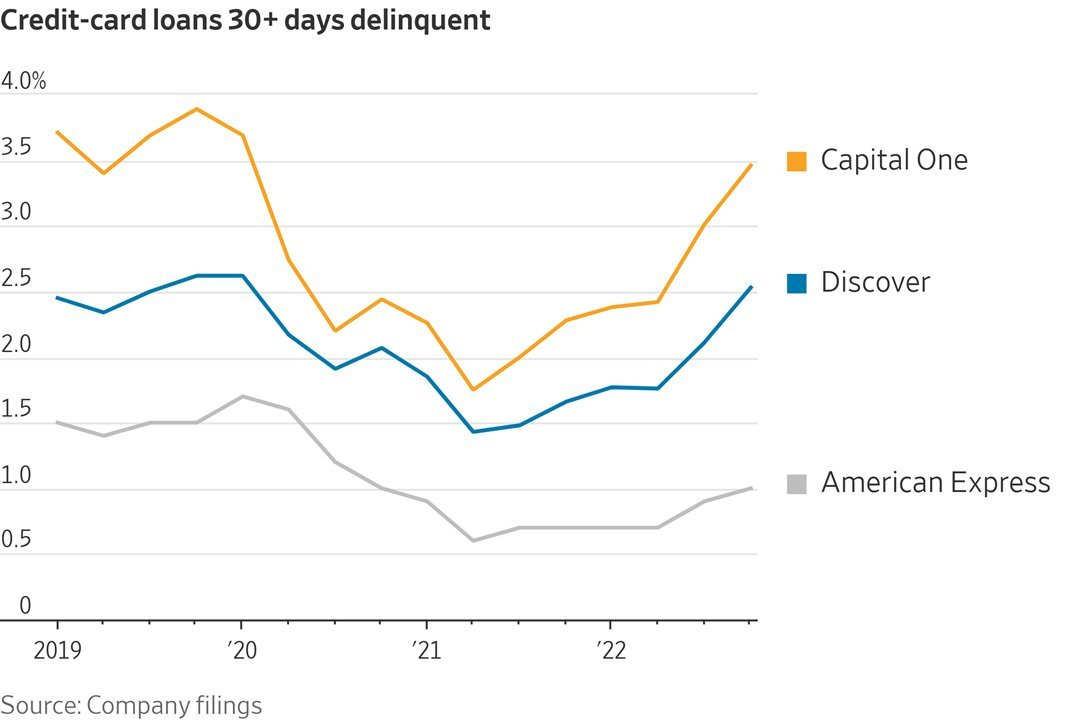

Macro data is measured month-over-month and year-over-year. Unfortunately, the man-made macro cycle will create misleading conclusions. For example, the strength of the consumer spending (70% of GDP) has been flagged as potentially “running out” when measuring rising balances and falling cash levels. However, rising credit card balances and delinquencies are simply resetting back to 2019 trend.

A true outlier period that includes macro data so artificial that it will render macro models unusable - garbage in/garbage out. Probably good practice to zoom out the macro charts beyond MoM/YoY. Below GDP chart shows how 2023 is back on trend, as if the prior 3 years were a contained chaos.

2023 is going to be the year after 2019 - job market still strong, wages growing ahead of inflation, and stock market in the final years of a bull market run.