Every smart person has the same forecast - a recession is coming with corporate earnings going lower and therefore so are stock prices. It’s smart because the first part is correct, but the second part - how stock prices will react - is where most are missing some context. Markets already reacted.

Markets figured out that growth would slow, as measured year-over-year, last March when SPX was at 4600. Macro values measured by the models had dived, followed quickly by Price down to 3600 in June. With The Fed just getting started, out came a plethora of 3200 predictions for second half of 2022. Despite the most aggressive monthly series of 75 bps hikes in history, each month the market waited for the recession, and SPX 3200, that never came. In fact, GDP grew at an uncomfortably high 12% annually over the second half of 2022 - the opposite of a recession. And incredibly, inflation collapsed in Q3 and Q4, just like SPX did in Q2.

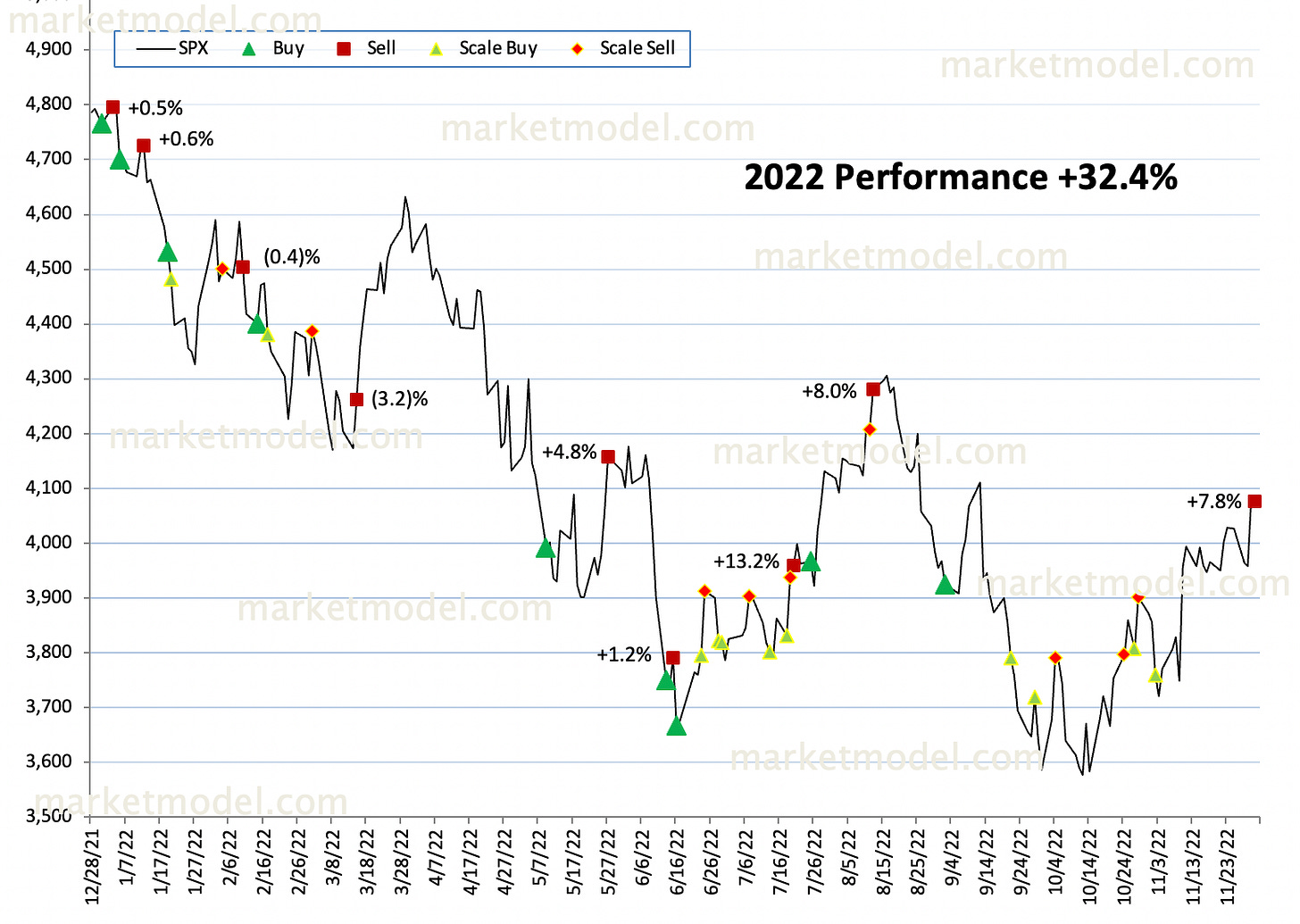

MarketModel was also consistently adding high probability scale trades each time SPX was near 3800 during the second half of 2022 (see green dots on graph). This demonstrates that Macro is doing too well for Price to be near the 2022 lows.

You can receive this updated signal chart at MarketModel

Recession forecasts have also provided a much needed adjustment to Employment. A surge in hiring during the 2020-21 years also went beyond peak levels and created unsustainable wage gains and WFH demands. In response, companies took advantage of bleak forecasts, and even though a recession still has yet to appear, announced 10% layoffs. The actual number of pink slips is a small dent, not even cutting into the tremendous over-hiring since 2019. But these cuts immediately put a stop to wage inflation as employees don’t normally ask for raises while co-workers are being sent home. In addition, these expense adjustments will soften the blow to record earnings during the slowdown.

And now interest rates, which everyone predicted would be pushed higher for longer. Since last June, I’ve been a fan of the 1994/95 analog for both Macro and Fed tightening. SPX bottomed in Dec 1994, and during this same period 10yr peaked and trended lower throughout 1995 (see below). If the Beyond Peak Cycle extends to rates, that would mean an adjustment lower. Use the 100 day MA as proof that the analog is still working.

See a pattern? Stepped up Macro, pushed beyond peak cycle, that adjusts lower just as quickly.

Growth is next, and the obvious decline in 2023 that everyone sees coming will happen. A reminder that Bullish conditions for the SP500 is Macro with moderate growth and moderate inflation. So slowing growth from TOO HOT to JUST RIGHT is an improvement. In fact, GDP is currently growing twice the rate of healthy. Watching GDP “recede” to moderate levels is the classic “bad news is good news” narrative. Embrace a slowdown because Price will.

I always end with “what changes my mind”, and it will be the Macro data. I was almost certain last March that a recession was coming in 2022, but the data changed my mind. Right now, adjusting down from Beyond Peak Cycle is working in series, and getting back to Peak Cycle has some life left before a rollover.